Apcotex - Bonds Beyond Chemistry

Company at a glance

Apcotex Industries Limited is headed by Mr. Atul C. Choksey, former Managing Director of Asian Paints Limited.

An ISO 9001:2015 certified Company, is also certified for ISO 14001:2015 (Environmental Management Systems) and ISO 45001:2018 (Occupational Health and Safety Management Systems). Apcotex is a Responsible Care certified Company.

- Apcotex is one of the leading producers of Synthetic Rubber (NBR & HSR) and Synthetic Latex (Nitrile, VP latex, XSB & Acrylic latex) in India.

- Company has one of the broadest ranges of Emulsion Polymers available in the market today.

- The various grades of Synthetic Rubber find application in products such as Automotive Components, Hoses, Gaskets, Rice De husking Rollers, Printing and Industrial Rollers, Friction Materials, Belting and Footwear.

- Apcotex’s range of Latexes are used for Paper / Paperboard Coating, Carpet Backing, Tyre Cord Dipping, Construction, Gloves-examination, surgical and industrial use, etc.

- Its state-of-the art manufacturing plants are strategically located on the western coast of India.

- Apcotex has significant global presence and for last few years has done business in all continents and several countries.

- Company exports to over 45 countries, including the Indian Subcontinent, Southeast Asia, the Middle East, Turkey, Japan, Africa, Europe, USA and Latin America.

Over the past several years, Apcotex has developed a strong Research & Development

base, which has enabled it to develop, manufacture and export products and compete effectively against

global players.

1. Synthetic Latex

- This is manufactured from downstream petrochemicals whereas natural latex comes from rubber plantations.

- Apcotex manufacture Styrene Butadiene latex, VP latex, Styrene Acrylic latex and Nitrile latex which caters to various industries like Paper/ Paperboard, Carpet, Tyre and Construction.

Latex use:

1. paper - Provides excellent wet and dry

binding strength; provides high

gloss and strength to coated

paper.

2. Carpet - Provide excellent

binding strength.

3. Construction - Provides excellent water

impermeability; enhances

bonding between new and

old concrete.

4. Tyre Cords

5. Gloves - Surgical and industrial

6. Specialty - Used in a range of specialty

applications such as gaskets, non-woven fabrics, abrasive paper,

textile finishing, cork sheets, etc.

2. Synthetic Rubber

- Synthetic Rubber is basically an artificial elastomer which are mainly polymers synthesized from petroleum by-products.

- Apcotex produces various kinds of Synthetic rubber from cold NBR to hot NBR with different distinctions.

NITRILE RUBBER (NBR)

- This is an unusual type of synthetic rubber which is resistant to oil, fuels and various chemicals. It is used in the automotive industry as well as several other industrial applications to make fuel and oil handling hoses, seals and various rubber products where ordinary rubbers cannot be used.

NBR POLYBEND

- Cost effective medium ACN blend used for general purpose automotive and industrial molded and extruded products, footwear products, etc. for general purpose automotive and industrial goods as well as Fire Hoses.

HIGH STYRENE RUBBER

- Provides various degrees of hardness and excellent processibility for Hawaii slippers and Micro-cellular sheets.

NBR POWDER

- Used in joining sheets, PVC modification, brake pads, friction materials, adhesives and other rubber applications.

Apcotex Industries Ltd. has 4 decades of experience in polymer manufacturing and have been

supplying base materials to large players in the Construction Chemical industry for many years.

ApcoBuild - Build Smarter

- ApcoBuild is the brand name of the B2C Construction Chemical business of Apcotex.

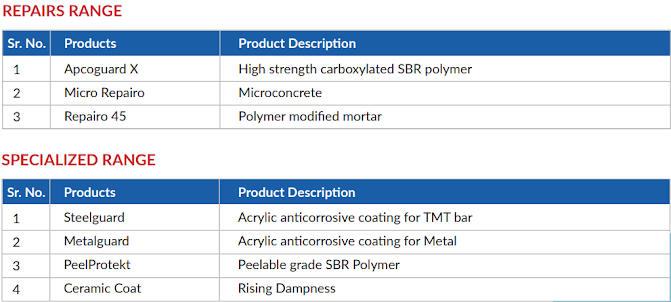

- Under the ApcoBuild brand, Apcotex provide best-in-class Waterproofing & Tiling solutions in India, through a wide range of products for applications in waterproofing, repair and rehabilitation of existing structures.

- It also offers a host of other product solutions for exterior coatings and concrete admixtures to satisfy all construction & civil engineering related problems.

- In last few years, company has managed to grow exponentially in terms of sales and also widened its geographic location.

- The global synthetic rubber market is expected to grow at a CAGR of over 4% over the next 5 years and at the same time Indian consumption of synthetic rubber is expected to increase at a CAGR of 6%.

- Similarly, synthetic latexes like Styrene-Butadiene latex, Styrene Acrylic, Pure Acrylic, Vinyl Acetate, Nitrile Latex, etc. are also expected to grow globally at an average CAGR of 4-5% whereas, in India, growth in demand is expected to be extremely strong at 8-10% due to population growth, consumer trends, and an increase in per capita GDP.

- Apcotex has one of the broadest ranges of specialty synthetic emulsion polymers and adds new grades and products every year which will support the future demand scenario. - (Import Substitution)

- It has developed Nitrile latex for gloves through internal R&D and successfully scaled up in FY20-21 and is currently only manufacturer in country. It has commissioned 50,000 MTPA facility at Valia plant which can be easily scaled to 80,000 MTPA.

- Apcotex is also a market leader in specialty rubber products i.e. NBR & HSR and has broadest range of emulsion polymer products.

- The Company’s major raw materials are petrochemical products, and its business could be vulnerable to high volatility in the prices of crude oil as well as its downstream products.

- It has registered a value and volume sales growth of 13% and 9% respectively over the previous financial year.

- Company exported 21% of its total sales revenue approximately and has reported a PBT growth of 12% on the back of increase in sales volume, introduction of new product, optimization of product and customer mix, adding new geographies.

- Company commissioned 50,000MT Nitrile latex plant in Valia, Gujarat & 35,000MT multi-purpose latex plant in Taloja, Maharashtra with a total investment of around 200Cr.

- Company has also completed a rebranding exercise in order to more effectively communicate what Apcotex stands for, both internally and externally.

- Apcotex has embarked on ESG journey, setting up its short term, medium and long term targets on several KPIs such as increasing green energy consumption, reducing waste, reducing water consumption/MT etc.

Outlook for Fy24:

- The Company expects financial year 2023-24 to be a challenging year due to a few reasons.

- The Gloves industry is still going through a deep downturn due to large excess inventories created in the last 2 years due to the pandemic. This, coupled with more capacities of Nitrile Latex, has resulted in significantly lower margins than anticipated in the short term and will have an impact on margins till demand picks up again.

- Despite the short-term challenges, your company is optimistic about its prospects with all the steps taken over the last 2-3 years.

- Company will continue to look for the opportunities in new adjacent products as well as opportunities for inorganic growth.

Risk & Concerns

- New Plant Risk – Nitrile Latex

- Delay in approval of product manufactured from new plant may impact budgeted sales for this financial year. To mitigate this risk, focus will on obtaining customer approvals as quickly as possible and to ensure the new capacity is filled as soon as possible.

- The other risk is on margins which is largely market driven and at the current stage lower than pre-pandemic levels. This was not anticipated earlier and in the medium-term is expected to normalize.

- Major risks arise from a few key raw materials like Styrene, Acrylonitrile and Butadiene. Butadiene is used in all products and is currently available from limited manufacturers in the country. If there is an issue with the supply of Butadiene on account of an unplanned shutdowns taken by a supplier, production of most of the products would be affected adversely.

- To mitigate this risk, we have business relationships with multiple suppliers and keep an adequate inventory and pipeline of Butadiene.

- Company has imported Butadiene for the first time in FY 2022-23 and are now confident of handling import of Butadiene, if required

3. Competition Risk:

- Excess Capacity and inventory of Nitrile Latex globally and Styrene Butadiene Latex excess capacity in domestic market may impact volume and margins in short term.

- To mitigate risk, in case of Nitrile Latex, focus will be on filling

capacity with positive contribution and ensuring new capacity

is filled over 18–24 months. In case of Styrene Butadiene

Latex, focus will be on filling capacity with healthy contribution,

maintaining domestic market share and increasing footprint

in export markets.

- Auditors

- Statutory Auditors - M/s. Manubhai & Shah LLP, Chartered Accountants (Firm Registration No. 106041W/W100136), as Statutory Auditors of the Company for a period of 5 years from the conclusion of this AGM till the conclusion of the 42nd AGM to be held in the year 2028, in place of retiring auditors viz. M/s. SGDG & Associates LLP, Chartered Accountants.

- Cost Auditors - M/s. V J Talati & Co., Cost Accountants have been appointed as Cost Auditors of the Company for the financial year 2023-24

- Secretarial Auditor - M/s. D.S. Momaya & Co. LLP, Company Secretaries, have been appointed to conduct the Secretarial Audit of the Company for the financial year 2022-23.

- Credit Rating

- ICRA has affirmed the credit rating of ICRA AA- ( stable) for the long term and ICRA A1 + for short term for working capital limits availed by the Company from the banks. This reaffirms the high reputation and trust the Company has earned for its sound financial management and its ability to meet financial obligations.

- Capex plan for Fy23-34?

- FY 2023-24 will be a year of consolidation and management do not expect major Capex projects to be undertaken in FY 2023-24.

- Future expansion plan with respect to Nitrile Rubber capacity to cater to both domestic and export markets?

- have almost tripled NBR sales over the last six years from the same plant. Being the only NBR manufacturer in India, company's intention is to increase NBR capacity from 21 KT to 36 KT at Valia, Gujarat plant.

- All the necessary statutory approvals have been obtained and currently they are working through the detailed designing of this project. The final decision on the timing of the investment will be taken over the next few months.

Financial Highlights

Segmental reporting

1. Balance Sheet

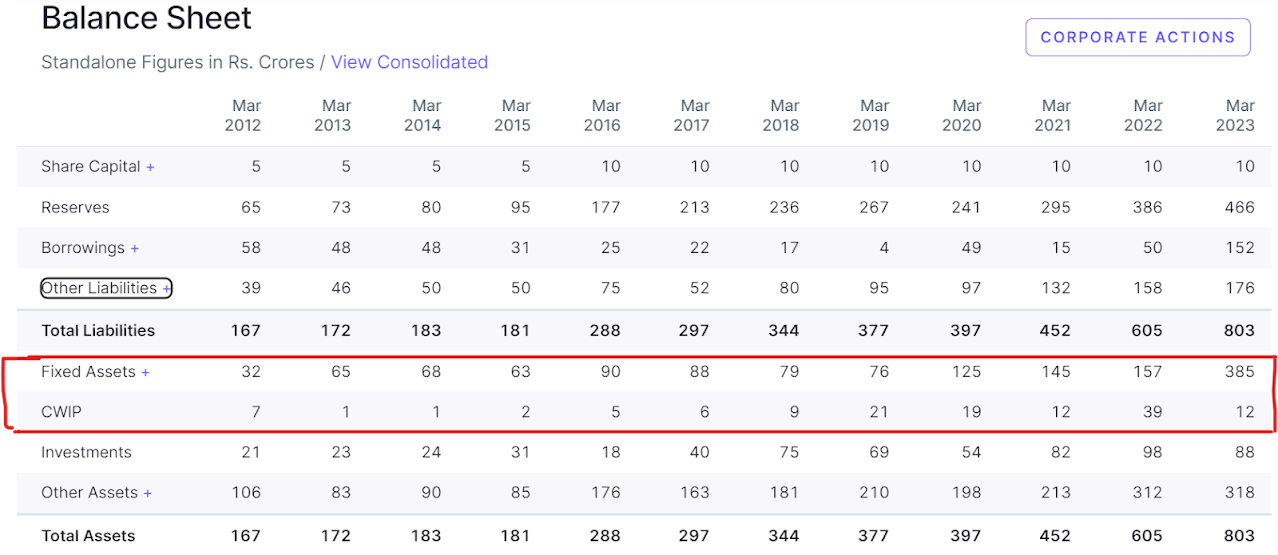

- Property plant and Equipment - Company has almost done 200Cr capex in last fiscal and therefore the net block has increased to ~383Cr. Also, WIP is around 12.3Cr ongoing, which will take the net block to 400Cr.

- Note: There are no projects whose completion is overdue or has exceeded the cost compared to its original budget

- If observed closely, company has almost done 12X capex in 10 years.

- Investment - Company has invested around 73Cr into different listed stocks directly or through mutual funds.

- Inventories - Company inventory has gone up by ~20% due to high stocking of the raw material to secure the supply to mitigate the uncertainties arising due to any COVID like situation.

- Trade receivable - Company has managed to lower down the debtor days cycle to 46 days from 62 days and thus able to efficiently manage the cash collection from customer .

- Company had made provision for doubtful trade of about ~72lacs and cumulatively of 4Cr

- Cash and Equivalent - Company has good liquidity to manage the day to day working capital requirement as it is generating a healthy cash and therefore it does not require much debt for running its day-to-day business.

- Equity share capital - Remains constant, shows company is not diluting it's stake to raise the capital thus indicating good financial stability.

- Term loan - Company has availed term loan as part of funding the capex which increases the debt of the company but comfortable enough as it is below 1X equity.

- Trade Payable - Company has managed to bring down trade payable from 61 days to 55 days which highlights company is generating enough cash to settle the vendor dues and therefore improving the cash conversion cycle.

2. Profit & loss statement

- Revenue from operation - Revenue growth in double digit around 12.9% in absolute term in which volume growth is around 9%.

- Other income - It is very minimal as %age of total revenue. It generally includes saving interest from bank deposits, dividend income, profit on sales of asset.

- Employee benefit expense - This increased which highlights increase in headcount as can be confirmed from the PF contribution from the company side.

- Finance cost - This is the interest expense incurred on account of the loans availed for CAPEX

- Miscellaneous expense: Seems to be inline and no such deviation from normal. Power and fuel cost increased due to inflationary environment during the year, freight and transport charges seems to be lower than previous year.

- Tax rate is 25.17% on the total profit generated by the company

- From Sales point of view, company is doing double digit revenue growth in recent years leaving the covid time - Revenue almost growing at 18% CAGR in last 6 years

- OPM is also inching towards 15% after covid recovery which is heartening to see

- Interest expense seems to be on lower side and not much of concern

- Tax rate is in line with the standard tax slab

- EPS in last 6 years has almost trebled growing at CAGR of ~20% almost

- Dividend payout is on lesser side as company is using the cash generated to do capex for more growth which seems to be good as more growth will propel the company to more earning and thereby good alpha generation.

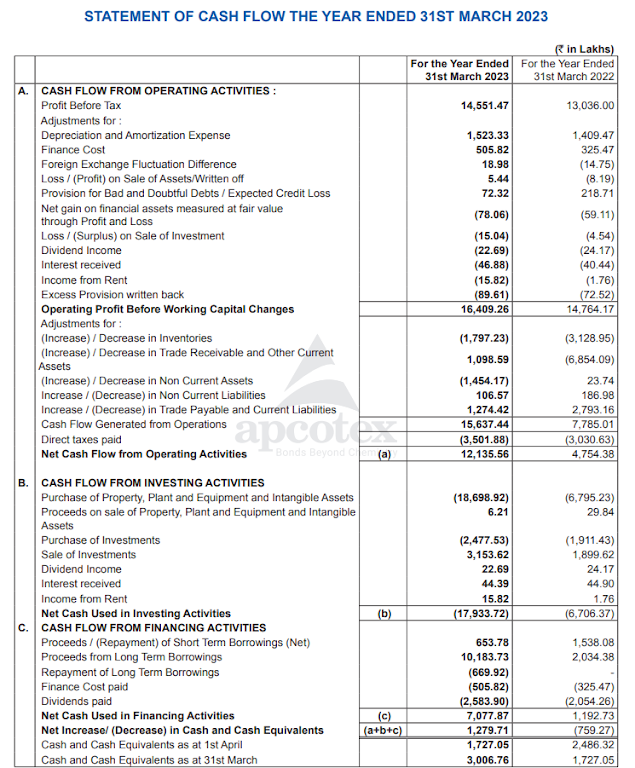

3. Cash flow statement

Shareholding parameter

This brings to an end of this annual report overview. Please do comment your valuable feedback and share the blog as a token of appreciation and also subscribe the blog to receive more such posts.Follow me on twitter @agarwal2rishabh.

Comments

Post a Comment