Cosmos First Q4FY23 Concalls & Credit report

Management Commentary

- First talking about the flexible packaging business. Although Quarter 4 was a fairly challenging quarter primarily for the commodity part of the business, however, the company could still post 10% EBITDA on the back of the specialty film portfolio. The results are clearly outperforming the industry.

Entire industry for BOPP and BOPET is under pressure due to over supply

- During the quarter, commodity films’ margins, both on the BOPP and BOPET witnessed a further decline compared to the previous quarter impairing the profitability of the entire industry. The BOPP and BOPET industry faced excess supply scenario caused due to bunching of several new production lines. Although, the demand side continues to grow. The bunching of supply caused margin drop and impacted everyone in the industry.

- Cosmo derive 2/3rd of the revenue from speciality films and 1/3rd from the commodity films (BOPP and BOPET)

Margins are depressed compared to March 2022

- BOPP films’ margins have been running close to Rs. 10 per kg in March 2023 quarter compared to Rs. 17 per kg in December 2022 quarter and Rs. 50 per kg in March 2022. This margin of Rs. 10 per kg is quite low compared to the average historical margins of Rs. 25 per kg that this industry has been earning.

For BOPET line commissioned in FY23

- The company is working on key speciality products on the BOPET line which are expected to deliver results within FY24. This is in line with the company's larger strategy to enter into polyester films.

On sustainability front, company has entered into renewable power agreement and will make 50% of the power requirement from same in medium term.

Outlook for current and upcoming quarter for packaging business

- company expects the position to improve in the coming months bringing an end to the QoQ decline, which has been happening from last three quarters continuously in a row.

Steps to preserve the margin in coming quarters

- The company has launched several new speciality films including shrink for packaging and non-packaging applications. Few other speciality films from non-packaging applications are also in the pipeline which should hit the market in the coming quarters. All these would further strengthen the company's position in its speciality films business.

- Q4 highlights

a. Revenue down by 2% due to lower commodity margin

b. Volume improved by 4% Q-o-Q

c. Result include one time operating losses for the pet care divison

d. Annualized ROCE continue to be upward of 16% and ROE of 20% which is industry leading

On Speciality film business

- Company is doing sales of 13% CAGR growth for last 3 years

- Sales remained mostly flat in FY23 due to inventory correction in export market but company expects the situation to improve in FY24

- Targeting double digit sales growth in FY24

On BOPET

- company is in process of launching several new specialty products including Heat control film, security film and PET-G film

- Heat film will be in market in second half of current financial year

On Flexible packaging

- work on BOPP and CPP line is progressing in line with the plan. Both the lines are world's largest production capacity lines and will increase company’s existing capacity by almost 45% in a phased manner by March 2025.

Company Subsidiary

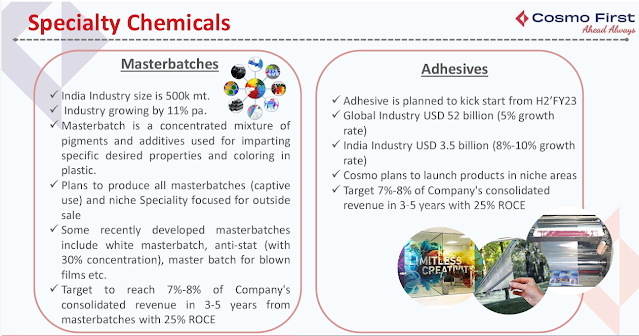

- Specialty Chemicals posted Rs. 35 Cr of sales during Q4FY23 which is 17% higher compared to similar quarter last year.

- The company could reach almost 75% capacity utilization on its master batch line

- The complementary adhesives business for packaging segment is all set to grow in current financial year.

Pet Care Division

- The company is direct to consumer vertical which was launched under brand Zigly in September 2021 is progressing in line with the plan.

- Started 15 experience centers as on March 2023 end and this is besides the sales through online portal and online app.

- Zigly so far have served more than 23,000 customers already with one third of the repeat customers.

- Besides organic growth, the company is also looking for inorganic growth for Zigly. So, an acquisition opportunity in the online pet care space is almost at the final stage and we expect it to close soon.

On Capex and Debt

- Company is looking for almost Rs. 500 to Rs. 550 Cr of CAPEX in a phased manner by March 2025, which will be largely value-add CAPEX on the BOPET line, CPP line and BOPP line.

- The current net debt of the company is Rs. 433 Cr as on March 2023, net debt/equity is at 0.3 times and 1 time of Net debt/EBITDA.

QnA

- Company is quite optimistic about the growth in speciality film business, but see some pressure in the commodity film business

- For Zigly, company is doing acquisition trying to address the fitment in retail and online sales channel betterment which can accelerate the overall growth with higher volume.

- Presence will be doubled in this fiscal from 15 to 30

- Demand side has been growing at 10% YoY

How to gain market share for the upcoming capex?

About Shrink products developed

5 year down the line, how the product mix will look like?

With 2 new lines coming up in FY24, possible guidance on margin

Shrink film market size in India

Export and domestic marker mix is 50:50 and biggest target market is America

- Update on new product development closely with FMCG player?

What sort of capacity will be added once BOPP and CPP line is commenced?- Capex guidance for chemical business and pet care division

On Inventory correction going forward

Concall end remark

Credit Report

Weaknesses:

1. Susceptibility to volatility in raw material costs and demand-supply dynamics

Outlook: Stable

CRISIL Ratings believes that the operating performance of CFL will benefit from its increasing share of specialty products segment and commencement of its BOPET capex plant in the medium term.

Do like, share and subscribe for more such blogs. Also visit the blog for other blogs.

Twitter - @Agarwal2Rishabh

.png)

Comments

Post a Comment