Usha Martin - Ready for another upward movement?

To be the global leader in the wire rope industry by delivering customer delight, adopting modern technology and ensuring sustainable growth for all of its stakeholders.

- Usha Martin's business model is primarily to stock and sell the through their own distribution centers worldwide in SE Asia, Australia, Europe, US, UAE and also do some direct sales from plant.

- In the past, Usha Martin was involved in the steel making business which was impacted due to the severe downturn in the industry and high leverage of the Company. To overcome these challenges, they undertook divestment of the steel business by way of a slump sale.

- This exercise enabled the Company to significantly deleverage and turnaround our financial and operational position. While it was a tough decision at that time, this helped us transform from a commodity business to a value-added high ROC business.

- It is important to note that the Company never defaulted, did not go for debt restructuring and there was no haircut by any of the lenders.

- Now, with the renewed focus on the specialty wire rope business, Usha Martin has undertaken strategic initiatives to enhance its production capacity for wire ropes, diversify its product range, restructure its cost, secure its raw material sources, and strengthen its financial position.

- Post the turnaround and stabilization, company has adopted the dividend policy and they have recommended dividend of 2.5/- per share in FY23

- This exercise enabled the Company to significantly deleverage and turnaround our financial and operational position. While it was a tough decision at that time, this helped us transform from a commodity business to a value-added high ROC business.

- It is important to note that the Company never defaulted, did not go for debt restructuring and there was no haircut by any of the lenders.

Diversified presence across the geographies:

- Ranchi

- Hoshiarpur

- Dubai

- Bangkok

- UK

- Silvasa

Global design center in Italy - Engaged in designing / using proprietary design software to develop best in class products.

- GDC has over 40 years of expertise in rope design and application engineering

- Provide technical guidance for product development

- Close co-operation with customers, universities and research institutes

SKUs: Highly customized offering have enabled high number of SKUs across various industries having critical applications ( Product mix - mental model (SOIC))

Company is undergoing a strategic transformation and is poised for the growth

Turnaround - Company divested its steel business resulting in deleveraging and healthy balance sheet.

Consolidation - Company renewed its focus on speciality wire rope business and taking up initiatives to maintain the leadership position.

Growth - undertaking value accretive capex, increasing geographical presence to drive the sustainable growth.

Target to achieve topline CAGR of 15% & operating EBITDA margins ~18% over the next 2-3 years.

Company is consciously taking decision to reduce share of low-value offering

Entry barrier:

- Critical component of End-product - Being critical component new entrants need to prove itself before any order from the company and thus provide inherent entry barrier - long customer approval time

- Close customer engagement - Customer engagements are built closely over a long duration based on trust and quality thus building a relationship and a barrier for new entrant. (Moat- Company has built the brand value over 60 years).

- High customer switching cost - being a customized product based on customer requirement there are switching cost to this as well as little incentive once the product is entrenched in the ecosystem.

- Technical know-how - It takes years to gain expertise and knowledge of the industry and build quality product

- High number of SKUs - Having high number of SKUs across different critical application gives an edge with diverse product mix and thus more optionality to customer thereby creating a long standing relationship

Company is also looking forward to provide service to clients along with product thereby offering the total solution.

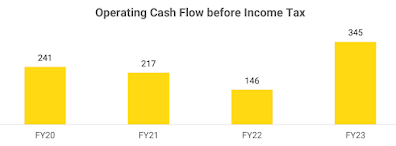

Company strategic investment have strengthened the operation and financial position of the company.

- Registering consistent performance by leveraging inherent strength

- Focusing greatly on high value offering to continue driving margin and overall growth

- Company is managing spread well despite volatility in steel input cost

- Focusing on international market thereby enabling higher value realization through increased engagement via total solution

- Management is walking the talk

- Company has robust pass on mechanism in place to manage raw material price volatility and deliver sustained EBITDA/mt

- Company has started distributing almost 22% of the PAT as dividend, in FY22 it was 21% and aspire to maintain the healthy dividends

- Moving forward, to sustain the revenue and continue with the growth momentum, company is working on below mentioned strategic plans:

- Current capacity in wire ropes, wire strands and LRPC

- Total current capacity is around 296-300,000 tons

- Current utilization is around 70%

- LRPC is between 60,000-65,000 tons

- Ropes would be close to 126,000 tons and current production is close to 101,000 tons

- Capacity utilization in international subsidiaries?

- As far as Dubai is concerned it is around 83%. Total capacity is 15,000, did about 13,500.

- USSIL is around 86%

- Brunton Shaw it is close to around 50%, but this is something company expect to grow with the various tractions what they have got in the international market.

- Capex initiatives

- Capex wave1 of Rs. 310 crore during FY22 at Ranchi expected to be completed by Q3FY24 –would result in capacity enhancement by ~47,000 mt/annum

- Capex wave2 of Rs. 167 crore proposed during FY24 at Ranchi –expected to be completed in the next two fiscal years –would result in capacity enhancement by ~10,000 mt/annum

- Capex waves include modernization of existing production facilities to improve infrastructure, productivity and reduce the cost to serve.

- Focus on achieving asset turns of 2–3x over the next two years at optimal utilization levels

- Capex program of Rs. 62 crore proposed at Thailand during FY24 to enhance wire drawing, stranding and closing capabilities –would result in capacity enhancement by ~3,000 mt/annum

- Total current capacity is around 296-300,000 tons

- Current utilization is around 70%

- LRPC is between 60,000-65,000 tons

- Ropes would be close to 126,000 tons and current production is close to 101,000 tons

- As far as Dubai is concerned it is around 83%. Total capacity is 15,000, did about 13,500.

- USSIL is around 86%

- Brunton Shaw it is close to around 50%, but this is something company expect to grow with the various tractions what they have got in the international market.

- Capex waves include modernization of existing production facilities to improve infrastructure, productivity and reduce the cost to serve.

- Focus on achieving asset turns of 2–3x over the next two years at optimal utilization levels

To fund majority of the capex through internal accruals about 20-25% would be through debt

- Increased capacities to primarily focus on value-added products such as mining ropes, non-rotating ropes, compacted ropes, plasticated ropes

- Expand international share through overseas subsidiary

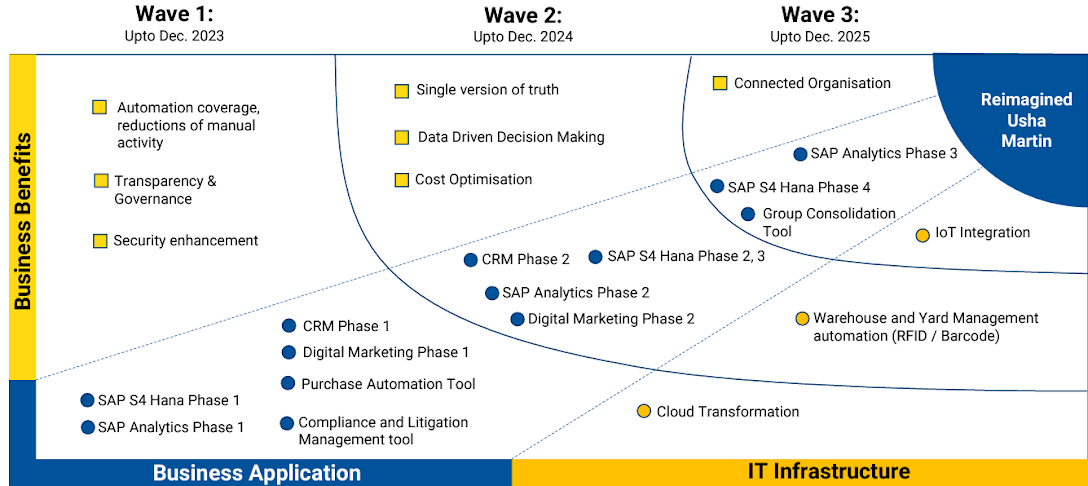

- Strong focus on Digital initiatives

- To remain financially prudent, company has outlined the future guideline basing FY22

Credit Rating

India Ratings and Research (Ind-Ra) has revised Usha Martin Limited’s (UML) Outlook to Positive from Stable while affirming its Long-Term Issuer Rating at ‘IND A’.

Concall Updates Q4FY23

- This is first concall conducted by management and they are optimistic of continuing this for more transparency and building stronger relationship with the investor community.

- This is first concall conducted by management and they are optimistic of continuing this for more transparency and building stronger relationship with the investor community.

Management commentry on key focus area at present

- Complete the modernization and capacity expansion plans that are focused on high value products

- Grow in international markets, by specifically targeting geographies where company has a low market share.

- Leverage Brunton Shaw UK premium brand to continue to secure businesses from premium customers and OEMs.

- Focus on digital initiatives to improve our operational efficiencies

- Double down on ESG initiatives across all plants with safety as the utmost priority

- Management believes that company is in very exciting phase and confident to capitalise on the growth opportunities which industry has to offer.

On Financial performance:-- Company achieved a 11.6% year-on-year increase in revenue during the quarter, primarily due to the improved realizations.

- Operating EBITDA for the quarter registered a healthy 44.3% increase on a year-on-year basis.

- Operating EBITDA per ton improved to Rs. 32,063 in Q4 FY23 registering a strong 65.9% year-on-year increase.

- Operating EBITDA margin for Q4 of FY23 increased to 18% compared to 13.9% in Q4 of FY22.

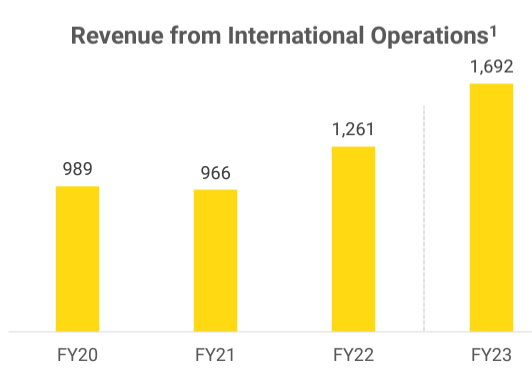

- International business accounted for 55% of our FY23 consolidated revenue compared to 51% in FY22 and registered a healthy growth of 34% YoY increase.

- Complete the modernization and capacity expansion plans that are focused on high value products

- Grow in international markets, by specifically targeting geographies where company has a low market share.

- Leverage Brunton Shaw UK premium brand to continue to secure businesses from premium customers and OEMs.

- Focus on digital initiatives to improve our operational efficiencies

- Double down on ESG initiatives across all plants with safety as the utmost priority

- Management believes that company is in very exciting phase and confident to capitalise on the growth opportunities which industry has to offer.

On Financial performance:-

- Company achieved a 11.6% year-on-year increase in revenue during the quarter, primarily due to the improved realizations.

- Operating EBITDA for the quarter registered a healthy 44.3% increase on a year-on-year basis.

- Operating EBITDA per ton improved to Rs. 32,063 in Q4 FY23 registering a strong 65.9% year-on-year increase.

- Operating EBITDA margin for Q4 of FY23 increased to 18% compared to 13.9% in Q4 of FY22.

- International business accounted for 55% of our FY23 consolidated revenue compared to 51% in FY22 and registered a healthy growth of 34% YoY increase.

QnA session begins

Europe although in recession, UMIL subsidiary registered a strong growth there - - First is organization structure. So, all international subsidiaries are now organized under one unified leadership and they do not work in silos. Earlier, Europe was managed by a separate management.

- Second, Brunton Shaw which is company's plant in the UK has performed really well. Previously, they would source their raw materials from other European sources, but now Brunton Shaw primarily buys their wires and strands from company's Indian plant. So, there is a strong raw material linkage which has formed within the Company that really helped the UK plant.

- Third, they have rationalized cost structure and overheads in the European entity that has helped a lot this year.

- Fourth, had breakthroughs with some premium customers in OEMs in the region through a strong technical support by our global R&D center which is located in Italy and we really expect to benefit from this over the next 2 to 3 years as well.

- Major sector company forsee the best opportunity to grow?

- Mining, cranes, Oil and offshore segments (booming in Europe)

- Company’s ability to pass on the raw material prices like steel, coal to the customers?

- Wire rope being the customized engineered product and therfore its pricing is not entirely impacted through the cycle of metal prices. The Company has not only been able to pass on the increased cost, but also managed to increase its EBITDA per ton over the last 2 to 3 years. This has been achieved through an active management of its product portfolio to focus on value-added segments like crane, oil and offshore, mining, elevators and fishing ropes and also increase the services business.

- The prices of LRPC and basic LRP is more indirectly linked to the strengths of the metal prices. These are generally the commodity products linked to the commodity prices, even in those segments the aim would be moving slowly towards more and more high value products like the plasticated LRPC which would have more the speciality flavour as well as in the wire business more and more on the speciality wires which we would develop. So, overall, Company has built up a product portfolio which to a great extent insulates it to any of these volatility of steel prices.

- Company outlook on US market as lot of infra capex ongoing?

- There is a lot of shortage of labor and supply constraints in the domestic market. So, have expanded management to set up own offices in the East and the West Coast and strengthened management team, built up stocking position in the US market and are focusing on the mining elevator and the crane rope market in those areas.

- They have even been able to get good OEM approvals in that market and while the US market is very large, company's percentage of share is only around 2% to 2.5% of the market. So, this gives an opportunity to increase and even with 3% or 4% market share almost volumes will double without really having a major impact in the overall market dynamics in the US. And UM's see a lot of success in terms of mining rope, trial results have happened which has done well.

- management guiding for working capital to come down to 150 days from current 177 days

- by increasing the realizations through value added services of cutting, coiling and other services to get more ROCE

- Lower freight rate and logistic rate will ease the inventory and therefore will help in improvement of WC.

- Margin across the product mix?

- Wire rope gives the highest margin

- Company is working more on value added LRPC than commodity LRPC to generate higher margin

- On Wire side company is exiting low value based wires and moving towards more of value based wires such as Galfan coated, Zinc aluminium wires etc which will give slightly more margin than normal wire

👇👇👇👇👇👇👇👇👇

- First is organization structure. So, all international subsidiaries are now organized under one unified leadership and they do not work in silos. Earlier, Europe was managed by a separate management.

- Second, Brunton Shaw which is company's plant in the UK has performed really well. Previously, they would source their raw materials from other European sources, but now Brunton Shaw primarily buys their wires and strands from company's Indian plant. So, there is a strong raw material linkage which has formed within the Company that really helped the UK plant.

- Third, they have rationalized cost structure and overheads in the European entity that has helped a lot this year.

- Fourth, had breakthroughs with some premium customers in OEMs in the region through a strong technical support by our global R&D center which is located in Italy and we really expect to benefit from this over the next 2 to 3 years as well.

- Major sector company forsee the best opportunity to grow?

- Mining, cranes, Oil and offshore segments (booming in Europe)

- Company’s ability to pass on the raw material prices like steel, coal to the customers?

- Wire rope being the customized engineered product and therfore its pricing is not entirely impacted through the cycle of metal prices. The Company has not only been able to pass on the increased cost, but also managed to increase its EBITDA per ton over the last 2 to 3 years. This has been achieved through an active management of its product portfolio to focus on value-added segments like crane, oil and offshore, mining, elevators and fishing ropes and also increase the services business.

- The prices of LRPC and basic LRP is more indirectly linked to the strengths of the metal prices. These are generally the commodity products linked to the commodity prices, even in those segments the aim would be moving slowly towards more and more high value products like the plasticated LRPC which would have more the speciality flavour as well as in the wire business more and more on the speciality wires which we would develop. So, overall, Company has built up a product portfolio which to a great extent insulates it to any of these volatility of steel prices.

- Company outlook on US market as lot of infra capex ongoing?

- There is a lot of shortage of labor and supply constraints in the domestic market. So, have expanded management to set up own offices in the East and the West Coast and strengthened management team, built up stocking position in the US market and are focusing on the mining elevator and the crane rope market in those areas.

- They have even been able to get good OEM approvals in that market and while the US market is very large, company's percentage of share is only around 2% to 2.5% of the market. So, this gives an opportunity to increase and even with 3% or 4% market share almost volumes will double without really having a major impact in the overall market dynamics in the US. And UM's see a lot of success in terms of mining rope, trial results have happened which has done well.

- management guiding for working capital to come down to 150 days from current 177 days

- by increasing the realizations through value added services of cutting, coiling and other services to get more ROCE

- Lower freight rate and logistic rate will ease the inventory and therefore will help in improvement of WC.

- Margin across the product mix?

- Wire rope gives the highest margin

- Company is working more on value added LRPC than commodity LRPC to generate higher margin

- On Wire side company is exiting low value based wires and moving towards more of value based wires such as Galfan coated, Zinc aluminium wires etc which will give slightly more margin than normal wire

👇👇👇👇👇👇👇👇👇

- Management suggests FY23 number to be considered as benchmark going forward

- Quarter-on-quarter variations may happen based on product mix, volumes and various dynamics at play, but overall compared to FY23 definitely expect sustainable growth in absolute volume and profitability numbers and the ROCE as well as EBITDA margins would continue to grow.

- And as the expansion is getting completed which is more towards wire ropes and also towards the specialized wire ropes and as we develop these markets, definitely, we see a higher traction both on EBITDA margin and ROCE and you will see an upper trajectory.

- Capex is on track -

- India

- End of Q3Fy24 Wave1 capex will come online

- Another plan of Rs. 167 crore which is expected to start almost by the time this is completed and that would take almost 18 to 24 months to complete (Increase in capacity of wire ropes by 10000 tonnes)

- Thailand

- Plan of modernizing this plant and expanding its capacity by investing Rs. 62 crore and this is going to enhance its wire drawing capabilities, stranding and closing.

- ROIC for the CAPEX?

- over next 2-3 years, moving towards 25% ROCE

- EBITDA margins to improve from 14-15% to 18%👍

- Why managements thinks its margin will improve from here?

- All the recent capex is towards getting the higher percentage of value-added product in their international business

- Product mix going forward

- Value-added ropes will contribute upwards of 65% in the wire rope segment and in overall, 44% of total product mix in current year.

- Will be aiming for 50% going forward in near term for the wire rope

- Out of 65K tons of capacity of LRPC, 500 tons of plasticated LRPC which is a value-added product will be commissioned and going forward will increase the capacity to 800-1000 toms in next 18 to 24 months

- Company is moving more into specialized wires segment, setting up GALFAN line which is zinc-aluminum combination. It will take 1-2 years to build up the market but is under value-added segment and therefore would give better margins than normal wire margin.

- So, company is building total capacity of 10000 tons of GALFAN and 10000 tons of special wires in over next 2-3 years

- Service business - Cutting, coiling and servicing

- Have 2 business under European subsidiary

- One in Aberdeen - supplies service to oil field sector in north sea

- one in Rotterdam - takes care of ports and related services

- Turnover of these 2 business is close to 700Cr

- Also started service business in Thailand, Singapore and Dubai

- Expect to grow business by 15-20% annually over next 3 years.

- Have good margins better than selling wire ropes by 4-5%

- Margins in value added ropes versus older wires and ropes?

- Value-added wires ropes are in excess of 50,000 per tons because of its critical application in cranes, mining.

- Some are even in excess of 270,000 per tons🤯

- General purpose ropes would be in between 20,000-25,000.

- High level of inventory locking up highest working capital - any inventory write down or losses risk if there is fluctuation in price of the steel?

- Company is able to withstand all the fluctuation post covid and able to manage the margin by doing pass through in the commodity wire ropes and LRPC

- In specialized wires, the margin is very acretive due to pricing power of the company and also the impact of high fluctuation in steel is not felt as the percentage of steel is very less compared to commodity wires ( 23% to 36% versus 67-78% )

- If the inventory contains all the finished goods?

Management seems pretty confident with good growth visibility. They are working at the peak utilization level and therefore at the peak volume. Expect to grow by 15-18% compounded in topline. Also, management is very much focused to consolidate the current business for next 2-3 years instead of venturing into new or inorganic growth opportunity.- In LRPC, company is not expanding capacity and therefore, no growth will happen there in coming years

- On Wire side, replacing low cost to high value items and higher cost

- So going forward, percentage of ropes will continue to grow, whereas, for wire, strands and LRPC would be almost at similar level what company is currently doing.

With this the blog comes to an end. If you liked the content, please do like, comment and subscribe to blog which will boost my morale to continue doing this blog on more of the companies.

- Management suggests FY23 number to be considered as benchmark going forward

- Quarter-on-quarter variations may happen based on product mix, volumes and various dynamics at play, but overall compared to FY23 definitely expect sustainable growth in absolute volume and profitability numbers and the ROCE as well as EBITDA margins would continue to grow.

- And as the expansion is getting completed which is more towards wire ropes and also towards the specialized wire ropes and as we develop these markets, definitely, we see a higher traction both on EBITDA margin and ROCE and you will see an upper trajectory.

- Capex is on track -

- India

- End of Q3Fy24 Wave1 capex will come online

- Another plan of Rs. 167 crore which is expected to start almost by the time this is completed and that would take almost 18 to 24 months to complete (Increase in capacity of wire ropes by 10000 tonnes)

- Thailand

- Plan of modernizing this plant and expanding its capacity by investing Rs. 62 crore and this is going to enhance its wire drawing capabilities, stranding and closing.

- ROIC for the CAPEX?

- over next 2-3 years, moving towards 25% ROCE

- EBITDA margins to improve from 14-15% to 18%👍

- Why managements thinks its margin will improve from here?

- All the recent capex is towards getting the higher percentage of value-added product in their international business

- Product mix going forward

- Value-added ropes will contribute upwards of 65% in the wire rope segment and in overall, 44% of total product mix in current year.

- Will be aiming for 50% going forward in near term for the wire rope

- Out of 65K tons of capacity of LRPC, 500 tons of plasticated LRPC which is a value-added product will be commissioned and going forward will increase the capacity to 800-1000 toms in next 18 to 24 months

- Company is moving more into specialized wires segment, setting up GALFAN line which is zinc-aluminum combination. It will take 1-2 years to build up the market but is under value-added segment and therefore would give better margins than normal wire margin.

- So, company is building total capacity of 10000 tons of GALFAN and 10000 tons of special wires in over next 2-3 years

- Service business - Cutting, coiling and servicing

- Have 2 business under European subsidiary

- One in Aberdeen - supplies service to oil field sector in north sea

- one in Rotterdam - takes care of ports and related services

- Turnover of these 2 business is close to 700Cr

- Also started service business in Thailand, Singapore and Dubai

- Expect to grow business by 15-20% annually over next 3 years.

- Have good margins better than selling wire ropes by 4-5%

- Margins in value added ropes versus older wires and ropes?

- Value-added wires ropes are in excess of 50,000 per tons because of its critical application in cranes, mining.

- Some are even in excess of 270,000 per tons🤯

- General purpose ropes would be in between 20,000-25,000.

- High level of inventory locking up highest working capital - any inventory write down or losses risk if there is fluctuation in price of the steel?

- Company is able to withstand all the fluctuation post covid and able to manage the margin by doing pass through in the commodity wire ropes and LRPC

- In specialized wires, the margin is very acretive due to pricing power of the company and also the impact of high fluctuation in steel is not felt as the percentage of steel is very less compared to commodity wires ( 23% to 36% versus 67-78% )

- If the inventory contains all the finished goods?

Management seems pretty confident with good growth visibility. They are working at the peak utilization level and therefore at the peak volume. Expect to grow by 15-18% compounded in topline. Also, management is very much focused to consolidate the current business for next 2-3 years instead of venturing into new or inorganic growth opportunity.

- In LRPC, company is not expanding capacity and therefore, no growth will happen there in coming years

- On Wire side, replacing low cost to high value items and higher cost

- So going forward, percentage of ropes will continue to grow, whereas, for wire, strands and LRPC would be almost at similar level what company is currently doing.

Twitter - @Agarwal2Rishabh

Soucre: 1. Company Concall Transcripts 2. Company Investor presentation

Twitter - @Agarwal2Rishabh

Soucre: 1. Company Concall Transcripts

2. Company Investor presentation

Comments

Post a Comment