Usha Martin Annual report - "Unified, Unwavering & Upward"

A turnaround story in play

Usha Martin Limited (the 'Company') is a public limited company incorporated and domiciled in India and is incorporated under the provisions of the Companies Act applicable in India.

The equity shares of the Company are listed on two recognised stock exchanges in India and its GDRs are listed on stock exchange in Luxembourg. The registered office of the Company is located at 2A, Shakespeare Sarani, Kolkata - 700071.

Outlook and business

While speculation of global economic slowdown, liquidity crunch due to interest rate hike to contain inflation by major economies, supply chain disruptions due to geo-political tensions is expected to continue, spending by Government of India in infrastructural and social welfare projects such as roads, railways, water and sanitation along with expected revival in auto sector will give an impetus to the demand of specialty products of the Company.

Company's commitment to quality is reflected in their in-house software and process optimisation, which ensures their products meet global standards.

With a strong global presence in >70 countries and international sales contributing to over half of company turnover, they have established themselves as a leading manufacturer of steel wire ropes worldwide.

"The decision to sell off the steel business has not only deleveraged our balance sheet but has enabled us to transform from a commoditized business to a value added high ROCE business focused on specialty wire ropes" - Rajeev Jhawar

Presence - A globally-local organization

Local Network

Glocal network - International Business

U M Cables Limited [UMCL]: UMCL is a wholly owned Indian subsidiary of the Company, engaged in business of telecommunication cables. Its manufacturing facility is located at Silvassa, India. The performance of UMCL during the year under review is provided herein under:

Management Discussion and Analysis

- During the year under review the steel industry was negatively affected due to disruption of supply-chain, increase of key input materials, global liquidity crunch due to increase in rates of interest by central banks of major economies including that of India.

- Development in sectors like oil & gas, port and mining have resulted in demand for the Company’s specialised products such as large diameter ropes, port crane ropes and mining ropes.

Financials

- Strategic capital expenditure - one of company's main focus areas would be to produce high value products.

- Expanding market segments and geographies - Successfully expanded their business by diversifying into various geographies and sectors. This has helped them reduce their dependence on a single product or market and enabled them to sustain growth and profitability. International business have recorded a substantial growth in revenue, and made up 55% of FY 2022-23 revenue.

- Leading through innovation - Upgraded its manufacturing facilities with technology to improve operational efficiency, reduce production costs, and enhance product quality.

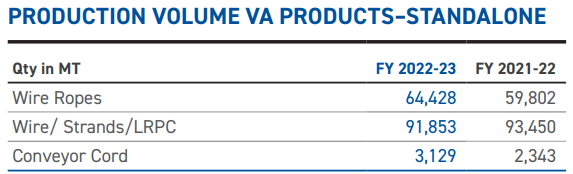

Volume growth

Health & Safety

MANUFACTURING FACILITY AT RANCHI IS CERTIFIED WITH ISO 45001:2018 A GLOBALLY RECOGNISED STANDARD FOR OCCUPATIONAL HEALTH AND SAFETY MANAGEMENT SYSTEM

Governance

- Certification of conformation with respect to Quality Management System under ISO 9001:2015 and Environmental Management System under ISO 14001:2015 continues to be maintained.

- Certificate of Product Design Assessment (“PDA”) issued by ABS, Ship/Offshore Engineering Department, Singapore is in place.

- Further the Company continues to have Approval of Manufacturing (“AOM”) from DNV-GL, ABS & Lloyd.

- The organization has a Certificate of Authority to use the official API Monogram issued by American Petroleum Institute, USA.

- The Company continues to have a number of product certifications such as BIS from Bureau of Indian Standards, Inmetro of Brazil, SONCAP of Nigeria, China Classification Society of China, NKK of Japan, Certificate of Recognition for BV Mode II scheme by Bureau Veritas, SIRIM QAS of Malaysia, SNI of Indonesia.

- The Mooring Line Base Design Certification conforming with Mooring Equipment Guidelines is in place.

- LRPC product continues to be certified by Australasian Certification Authority for Reinforcing and Structural Steels Ltd and the Company is an approved manufacturer and supplier of wire ropes to mines recognized by Directorate General of Mines Safety, Dhanbad, India.

- The Company is also an approved manufacturer of elevator ropes recognized by TUVSUD.

- The Company has also received recognition as approved manufacturer of galvanized core wire from PGCIL, India.

- Further the Company continues to have Certificate of Accreditation in the field of testing as per ISO 17025: 2017 by National Accreditation Board for Testing & Calibration Laboratories (NABL).

Litigations:

- The Central Bureau of Investigation (“CBI”) registered a regular case on 20th September 2016 (“FIR No. 1”) under the Indian Penal Code, 1860 (“IPC”) and the Prevention of Corruption Act, 1988 (“PC Act”) against certain individuals and the Company, wherein, inter-alia, various illegalities have been alleged qua the allocation of mine to the Company and abuse of official position by government servants. On October 2020, CBI registered another first information report (“FIR No. 2”) under the PC Act read with the IPC against the Company, few officials of the Company and others, alleging influencing of the investigation in FIR No. 1 for which proceedings are pending adjudication at CBI Court, New Delhi.

- The Directorate of Enforcement (“ED”), Patna passed a provisional order dated 9th August 2019 (“Provisional Order”) for provisional attachment of certain immovable properties of the Company valued at approximately Rs.190 Crore pertaining to the wire rope business of the Company, situated at Ranchi in the State of Jharkhand. This order was passed in connection with sale of iron-ore fines in earlier years from the erstwhile iron-ore mines of the Company situated at West Singhbhum in the State of Jharkhand. On 10th January 2020, the Adjudicating Authority under the Prevention of Money Laundering Act, 2002 (“PMLA”) issued an order confirming the Provisional Order, subsequent to which the Company filed applications for stay and appeal against the order of Adjudicating Authority, PMLA, with the Appellant Tribunal, PMLA, New Delhi. The Appellant Tribunal vide an order dated 31st January 2020 directed that status quo be maintained and presently the matter is pending adjudication before the Appellant Tribunal. ED filed a complaint followed by a supplementary complaint before the District and Sessions Judge cum Special Judge, Ranchi (“Ranchi Trial Court”) which is pending adjudication at Ranchi Trial Court. Further, in connection with FIR 2, ED filed a complaint before the Special Court, New Delhi (“Special Court”) under PMLA which is presently pending adjudication at Special Court.

Auditor

Key financial Ratio:-

Opportunities: −

- Growth in oil & gas and renewable energy sectors specifically offshore wind projects.

- Opportunities in Latin America mining sector is expected to augment exports. \

- Strong activity level in shipping and container terminals

- Supply chain disruptions and higher cost structures faced by global competitors

- Revival in automotive sector and government policies for development of infrastructure projects and thrust on “Make in India” will boost demand for the Company’s specialty products.

Threats, Risks & Concerns: −

- Slowdown of major economies might impact growth plans of the Company.

- Tightening of interest rate regimes by central banks of major economies may continue to be a deterrent factor.

- Inability to pass-off the effect of adverse movement of prices of key input materials and rising freight costs.

- Geo-political tension in Eastern Europe might adversely affect supply-chain and receivables.

- Re-emergence of Covid may dampen business and operations.

Comments

Post a Comment